The partial exemption is one of the biggest innovations that make up the Tax Adjustment Package.

In the São Paulo ICMS Regulation, the exemption hypotheses are provided for in Annex I. All exemptions known so far were applied to 100% of the value of the operation or installment. Thus, when there was an exemption, there was no payment of ICMS on account of this benefit.

With the publication of Decrees nº 65.254 / 2020 and 65.255 / 2020, this metric will be modified for some specific segments, and a partial exemption will be granted.

The partial exemption may vary from 75% to 80%. The percentage will be defined according to the tax rate or the tax burden applied to the operation or to the benefited benefit.

• Partial exemption x reduction in the calculation base

It is not common for ICMS legislation to refer to partial exemption.

Researching the topic, we see renowned tax experts indicating that, for tax purposes, the reduction in the calculation base would be equivalent to a partial exemption.

The STF itself manifested itself in this regard, in the judgment of Extraordinary Appeal (RE) 635,688.

In fact, it is possible to notice similarities, such as:

a) use of credits – in the case of exemption in subsequent operations, it is not possible to take advantage of the credit related to the entry. In the case of a reduction in the calculation basis for subsequent operations, the credit will be proportional to the portion taxed on exit, with no right in relation to the reduced portion.

b) tax bookkeeping – before the advent of Digital Tax Bookkeeping (EFD), when bookkeeping the Entry and Exit Registration books, in the case of operations with a reduction in the calculation basis, the reduced portion was recorded in the “Exempt” column in the books.

Therefore, it can be concluded that the reduction in the calculation base and the partial exemption are very similar institutes.

• Exemption percentages

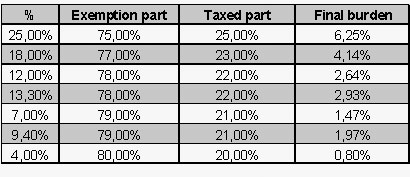

The exemption percentages will be defined according to the rate applicable to the operation contemplated by the benefit.

In the table below, all exemption percentages can be viewed, according to the tax burden that would be applicable in each case. The first column on the left shows the rate. The exemption percentage varies according to the applicable rate.

• Application hypotheses

Not all operations or services provided for in Annex I of the RICMS / SP will have their exemption partially applied.

The changes in the legislation have clearly demonstrated the benefits that will be affected by this partial taxation rule. When the article in Annex I refers to “item 2 of the sole paragraph of article 8”, it means that the partial exemption applies.

Articles in Appendix I that do not have such an indication continue with the normal exemption rule that you already knew.

Some examples of segments that are now partially exempt:

– Fruits and vegetables – Articles 36 and 104 of Annex I

– Agricultural inputs – Article 41 of Annex I

– Raw, pasteurized or rehydrated milk – Article 103 of Annex I

– Digital goods and commodities (software) – Article 172 of Annex I

• Simple national

Today, the exemptions provided for in Annex I of the RICMS / SP apply to companies opting for Simples Nacional (according to article 8, sole paragraph, of the RICMS / SP). These companies will also be entitled to partial exemptions.

However, a very important detail needs to be considered: today, there is already a total exemption, and as of next year, that changes, becoming partial exemption. In other words: in practice, companies that operate with such products will have an increase in their tax burden, because the exemption that is total will become partial.

•Validity

Partial exemptions will be valid from 2021.

This point deserves a little more attention, as these are two dates that the taxpayer needs to observe.

For operations or services that were subject to the regulation of partial exemptions by Decree nº 65.254 / 2020, the changes will be applied as of 01.01.2021.

As for the partial exemptions regulated by Decree nº 65.255 / 2020, the changes will take effect as of January 15, 2020.

It is important to note that this measure is temporary, and will have a duration of 24 months from the beginning of its effectiveness.